DIGITAL PAYMENTS IN SMART CITIES

Introduction

A Smart City, by definition, attempts to attain progressive growth, alongside environmental sustainability, social inclusion and ease of living via implementation of various ‘Smart’ solutions. Payments, featuring in a majority of the basic services availed by citizens, form the core of every economic activity in a city. Accordingly, it is imperative for the Smart Cities to transform their existing payments framework into smart payments by inclusion of various digital payment modes across variety of payment transactions including G2C, C2G, G2B and B2G payments.

Implementing digital payments in Smart Cities

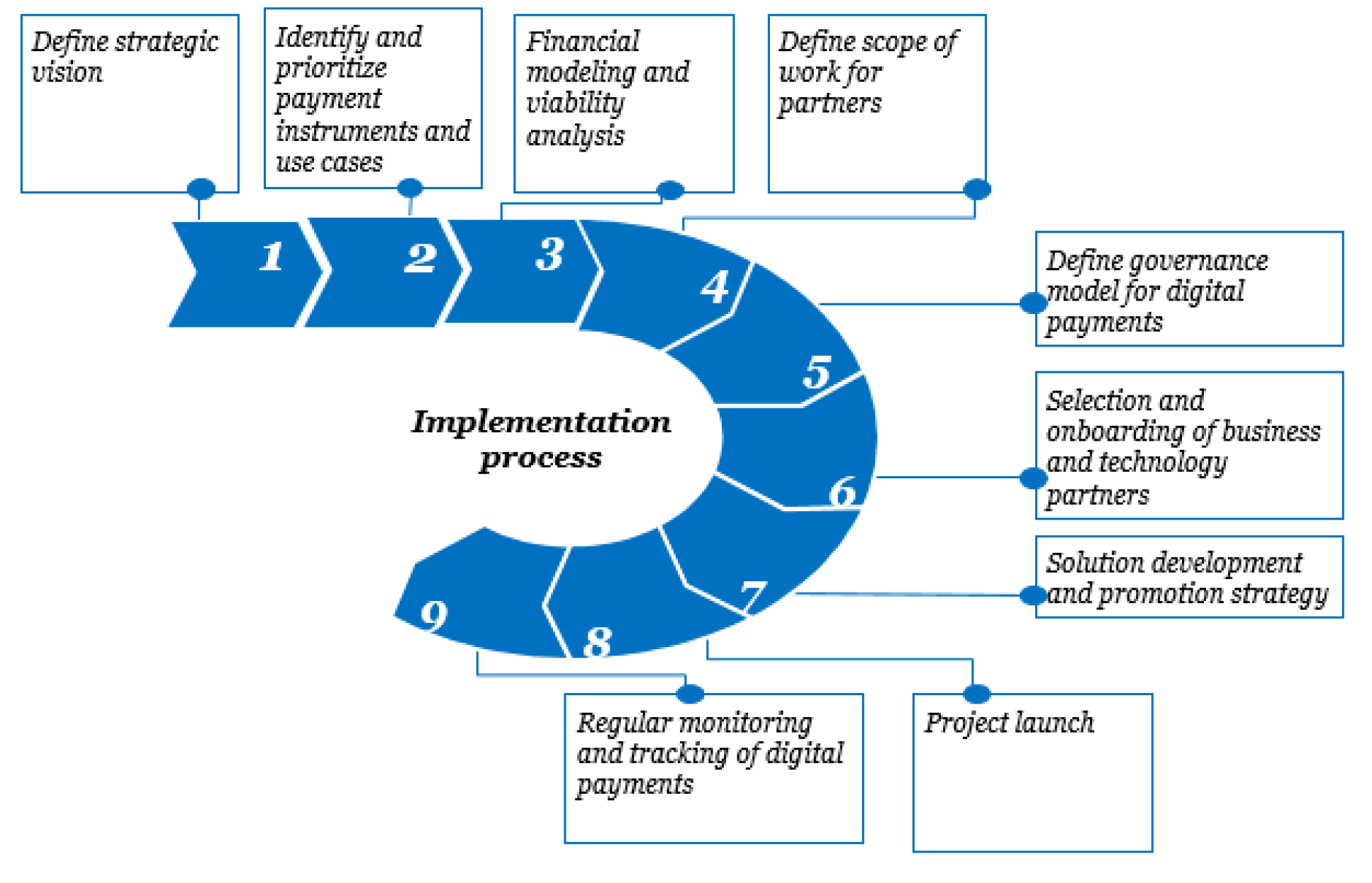

With the intent well in place to improve the payments ecosystem across various departments in Smart Cities, listing down few guidelines and step-wise implementation approach which each city can follow and/or customize as per their unique city requirements, in order to boost the digital payments:

- Strategic vision, mission and goals of payments platform

- Payments use cases

- Financial modeling and viability of payments platform

Define Strategic Vision:

A strategic vision for the implementation of digital payment initiatives must include: Clearly defined goals, high-level business need, criteria for selection of technology & business partners, project execution, promotion and sustenanceIdentify and prioritize payment instruments and use cases to be implemented:

The digital payments landscape in India offer a variety of payment options for consumers and merchants. It can range from the traditional channels including NEFT, RTGS and Cards to various innovative payment modes. Arrival of technology first companies like Google, Samsung, and others (Telecom companies, FMCG players and payment processing companies) has led to the introduction of many innovative solutions digital payments, which includes wallet-based payment system, QR code based mobile payments etc. that can even be used by people without any bank accounts. Another example of innovations across acquiring, is the adaptation of the legacy PoS system to accommodate newer modes of payments such as QR codes and UPI. Similarly, Government of India and RBI backed payment technologies provide more options for promoting digital payments: BHIM-UPI, Bank specific UPI payment options, Bharat QR, UPI QR, Aadhaar based payments (biometric), viz. Aadhaar Pay etc. Given the amplitude of digital payment solutions available, an assessment need to be carried out to ascertain target audience in each Smart City, their preferences viz. a viz. cost to the Government organization that wants to implement the same. In addition, various use cases across departments need to be mapped basis the ticket size and transaction volumes and the suitability of each payment instrument for the specified use case. The out-come of such an assessment will help Smart Cities identify, prioritize and implement digital payment platforms that may support multiple payment systems in phased manner. Smart Cities need to deploy an in-house dedicated team to carry out the assessment or can onboard payment specialists (consultants, banks, technology firms) to finalize the strategy accordingly.Financial modeling and viability analysis:

The success of digital payments largely depends on a robust financial model to drive the project. Financial model will include the following elements:- Identification of revenue and investment sources (banks / citizens / Smart City funds etc.)

- Transaction pricing models (flat fees, per transaction fees, slab - based pricing etc.)

- Business models (partnerships, revenue sharing, profit sharing etc.)

- Investment required on infrastructure, human resources, technology etc.

Define scope of work for partners:

Detailed document is required to be prepared and handed over to all stakeholders (Internal and external i.e. vendors selected for the process) for their review and sign-off. Detailed business requirements document need to be prepared which includes description and ‘As-is’ and ‘to-be’ functional and technology requirements that the payment system is expected to deliver. Accordingly, system architecture and approach document would be prepared for IT teams and vendor.Define governance model for digital payments:

A governance framework is required to be in place for the safe and smooth implementation of any system, especially for payment systems as these systems and stakeholders involved are greatly impacted regulations and policies. The governance framework should include, but not limited to, guidelines for:- Appropriate use and control of the systems,

- On-boarding and access rights for users,

- SOPs xvii for customer onboarding, creating, managing and closing requests

- Data and information security

Selection and onboarding of business and technology partners:

The common process for vendor selection and onboarding are Request for Proposal Approach, Direct onboarding from empaneled vendors and partnership models (revenue sharing / profit sharing models). The selection of process largely depends on factors like:How soon the system is required to be launched, e.g. NEFT, RTGS or payment gateway systems can be quickly launched with help one of the Banks with whom the Smart City is already having an account. Launching a new wallet or card may take anywhere between 2-3 months, however can facilitate additional user convenience.

Whether there is authorized payment service provider who can provide the system e.g. BBPOUs licensee w.r.t to the BBPS payment system, PPI license holder for offering wallets / smart card based prepaid solutions

Gamut of payment services provided by banks or technology providers: While banks may facilitate most of the payment solutions, however few technology players specializing in particular type of payments (wallet solutions, POS, doorstep services etc.) can also be considered depending upon use case requirements

Competitive pricing structure provided by the vendors

Public private partnership (PPP) models can also be considered for payment projects requiring intensive investment. For e.g. few transportation authorities have entered into PPP model with banks to set up the AFC system for fare collections under the National Common Mobility Card framework.

Solution development and promotion strategy testing:

The solution should have modular design and comprise of separate units each specified for user on-boarding, creation of services request, workflows to manage and process each request, transaction processing units, accounting units, databases, exception handling etc. The users and other stakeholders should conduct thorough testing of the system to check for anomalies and bugs before the citizen launch. The system should be tested for each module and its capabilities to handle large volumes, stress management, application security and fraud etc. While launching the services / products, a promotional strategy is necessary to migrate end users on digital payment channels and prevent staff from slipping back to the old ways i.e. cash or cheque-based payments. This specially applies to citizens, those who are technology averse or not willing to pay convenience fee or invest money on purchasing technology like high-end phones and personalized cards for digital payments. Cashbacks, tax incentives, loyalty programs etc. are few effective ways for ensuring citizen stickiness via monetary incentives. Apart from monetary benefits, promotional campaigns need to be designed towards educating citizens regarding ease of use of digital payments, hidden costs of cash, benefits and incentives for adopting digital payments etc. Promotions can be planned around festivals to digitize those payments.Project launch:

Post UAT sign off the system needs to be migrated to production. The user needs to be provided with proper training and hand holding exercises to enable them function well in the digitized systems. Manuals and process flows are required to be shared with users and walk through programs are a must.Regular monitoring and tracking of digital payments:

Government department’s need to continuously monitor the progress and growth of transaction happenings through various digital payment modes implemented. Dashboards also need to be created for regular tracking of digital payment initiatives by senior management.

Smart Cities can onboard payment service provider by one of following approaches:

- Request for Proposal evaluation process

- Direct onboarding from empaneled vendors

- Partnership models (revenue sharing / profit sharing models)

Enabling digital payments and way forward

Lack of strategic vision:

Challenges: Due of lack of common strategic vision across various departments, most of the digital initiatives does not reap its potential benefits. There is lot of reluctance seen across employees across department and across various levels of hierarchy.

Mitigation planning: Organisations need to clearly define their short term and long term goals and accordingly align their digital payment initiatives to avoid a lack of direction and ensure a clear way. Employees across departments need to be well-versed with the need and advantages of the payments systems so that these can be percolated to all levels across organization. Various programs / trainings need to be conducted across the organization on digital payments.

Sustainable financial model:

Challenges: In certain cases, digital payment initiatives don’t have proper financial planning which results in huge financial impacts. There are no separate budgets allocated for the payment initiatives, which leads to reluctance from senior management to implement such initiatives. Awareness regarding monetary benefits is lacking and most of the departments consider it as a cost center.

Mitigation planning: The development of a sustainable model to implement digital payments requires a clear vision on ways to generate enough revenue from digital payments services for all stakeholders so that the costs to drive the digital payments systems are paid off. The success of digital payments largely depends on a robust financial model to drive the project. Unless proper incentives are built in, the project may get stalled. Government departments can also learn from various digital payment success stories across India and their financial impacts.

Reducing reliance on manual processes:

Challenges: Manual processes can be reliable as long as volumes of service requests and processing payments are low. With increase in volumes the chances of errors increase and TAT for processing and delivering services may get impacted.

Mitigation planning: Various digital software would be required to reduce dependence on manual work for various payments and receipt transactions. It includes electronic billing systems, reconciliation system among others. A centralised system, which can digitize all processes, need to be implemented so that the billing systems can be automated. Similarly, reconciliation system would be required to reconcile transactions across various services / department / payment modes etc.

Lack of digital data:

Challenges: Currently most of the data and citizen records across various Government departments are available in physical format. Availability of data in digital form is primary requisite for any digital payment initiative.

Mitigation planning: Leading Municipal Corporations have undertaken dedicated projects wherein outside vendors have been on-boarded to convert the existing physical paper based data and information into the digital formats.

Lack of infrastructure:

Challenges:Infrastructure to support working of internet of things, telecommunications and network is currently limited, and the challenges are even more prevalent in urban peripheries. Unless there is availability of high speed internet connectivity, consistent mobile network and latest technology like smart phones and computer devices with accessories like POS, Finger print machines for biometric authentication etc., any digital payment initiative is short lived.

Mitigation planning: Active participation from various supporting Government bodies is needed to ramp up the infrastructure availability. The Smart City along with such supporting Government bodies, as needed should immediately draw up a plan for the same and implement it within a given period of time 6. Lack of awareness and motivation of end users: Challenges: Lack of awareness of financial concepts with consumer results in confusion, apprehension and obstacles that prevent people from availing products and services using digital payments. According to a survey by Standard & Poor’s Financial Services LLC, 76% of Indian adults are unable to understand key financial concepts, which is seven percentile points lower than the worldwide index. Currently, the awareness regarding the modes of digital payments and more so their ease of transactions is very limited, and it is even more prominent in semi-urban and rural areas. Mitigation planning: A comprehensive digital literacy drive need to be taken up across all stakeholders especially the marginalized and underprivileged communities – by Government, by banks and by regulators. Joint efforts across various stakeholders in payments ecosystem will ensure that digital literacy reaches at mass level in all our Smart Cities.

Designed and Developed by NIUA. All rights reserved.